Let’s get straight to the point and take one of the Hotel Groups we work with. They have 25 Hotels in their portfolio and have centralised Revenue Management and Distribution. Total Room Revenue is 195M euros. Total Acquisition costs including Payroll, Sales and Market spend and commissions is 42M euros That makes 21,54% acquisition costs. Net Revenue Contribution is therefore at 78,46% and 153M euros.

42M euros is a significant number and weights quiet heavily on the P&L. Now the goal this group set for themselves is to move the needle step by step by being both strategic and tactical.

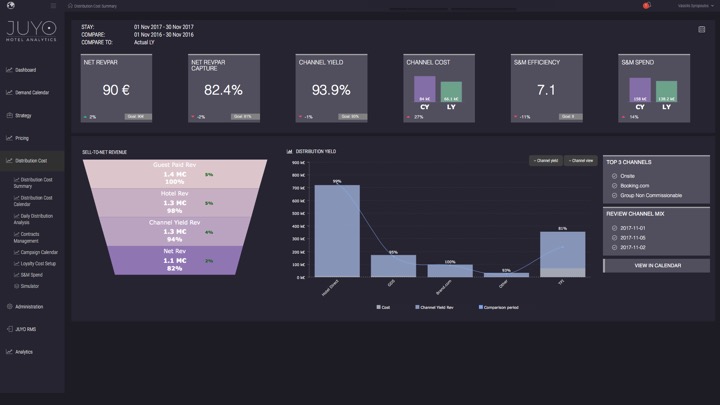

We start with the big picture. Where do we stand? Map all the transaction-based costs at the most granular level and then add all the sales and marketing spend. For the sake of full automation, we wrote an interface to the finance system. Even though the data at this level is strategic still the availability of it is real time. At this point you know where you are and that means that you can set a strategic direction about where you want to be. The data is as granular as it gets and allows you to filter down to a combination of channels and segments. Acquisition costs are mapped at the transaction level.

From that point onwards you take a high-level view of your marketing spend vs your segment and channel performance. Is investment in balance, does it yield the right ROI? am I overspending in a particular department or underspending against a …

You can read the rest of the article, here.

Written by Vassilis Syropoulos, Founder and CEO of JUYO Analytics.